Summary

Young Renters in California are Extremely Rent-Burdened

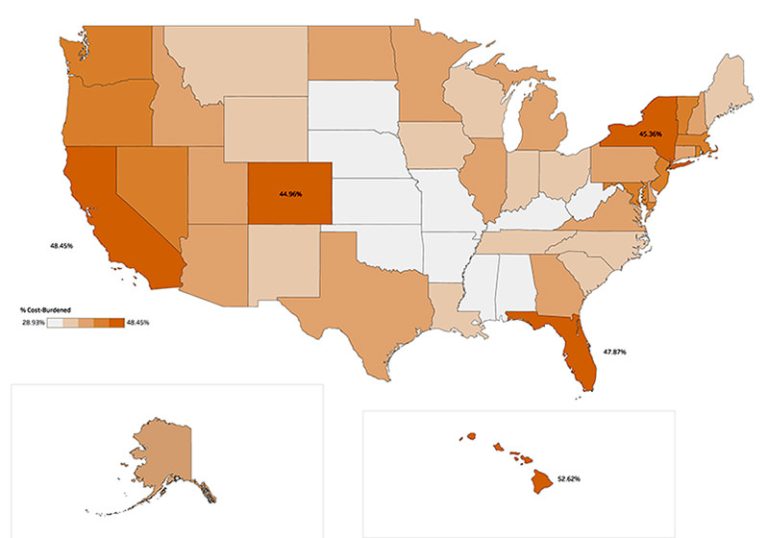

Rising rents in California have exacerbated financial challenges for a broad segment of the population. Across the state, 46% of renters are rent-burdened with annual rents exceeding 40% of their post-tax income. The picture is bleaker for people on the lower end of the income spectrum; among renters earning less than $25,000 after taxes, more than 3.3 million people, or 70%, are rent-burdened. The trend of rising rents and tightening rental markets is not new. For the past several decades, population growth, limited construction, and low vacancy rates have played a role in driving up rental costs. Today, California cities dominate the upper ranks of the nation’s most expensive rental markets; cities in the top eleven include San Francisco, San Jose, Oakland, Orange County, San Diego, and Los Angeles.

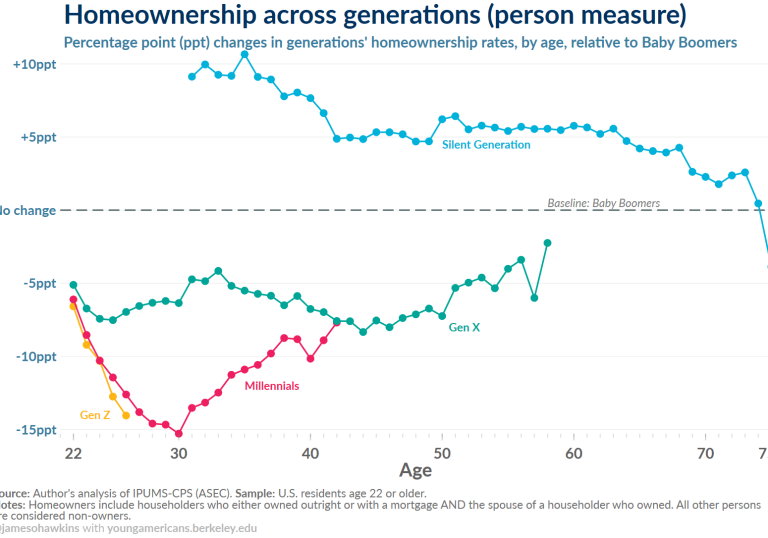

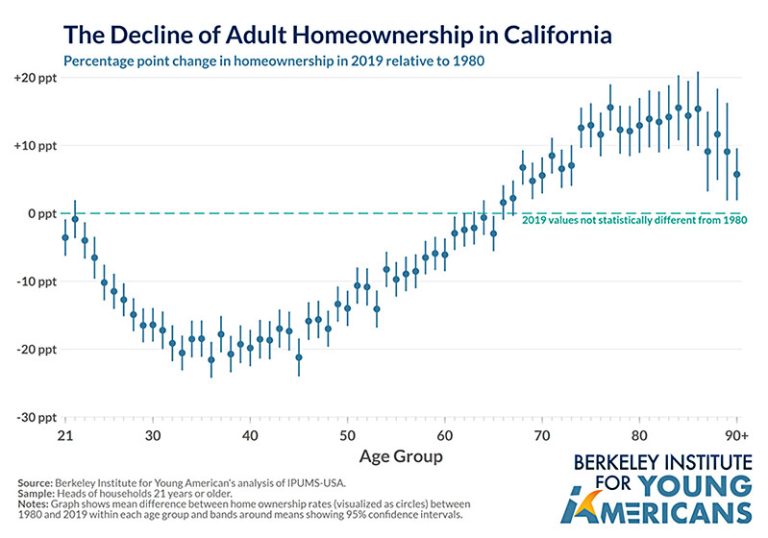

The problem of rising rents is particularly pronounced for young people in the state. With a rapid decline in homeownership among millennials, California’s population of young renters has grown significantly. Currently, millennials make up the largest proportion of burdened renters, with more than 1.7 million millennial tax filers spending more than 40% of their post-tax income on rent. Millennials have also seen the greatest increase in rent costs since 2002. From 2002 until 2008, rent prices increased at a faster rate than median income among renters. When incomes fell during the Great Recession, rent costs for young renters only plateaued and have continued to grow faster than income throughout the recovery.

The Tax Code Overwhelmingly Favors Homeowners

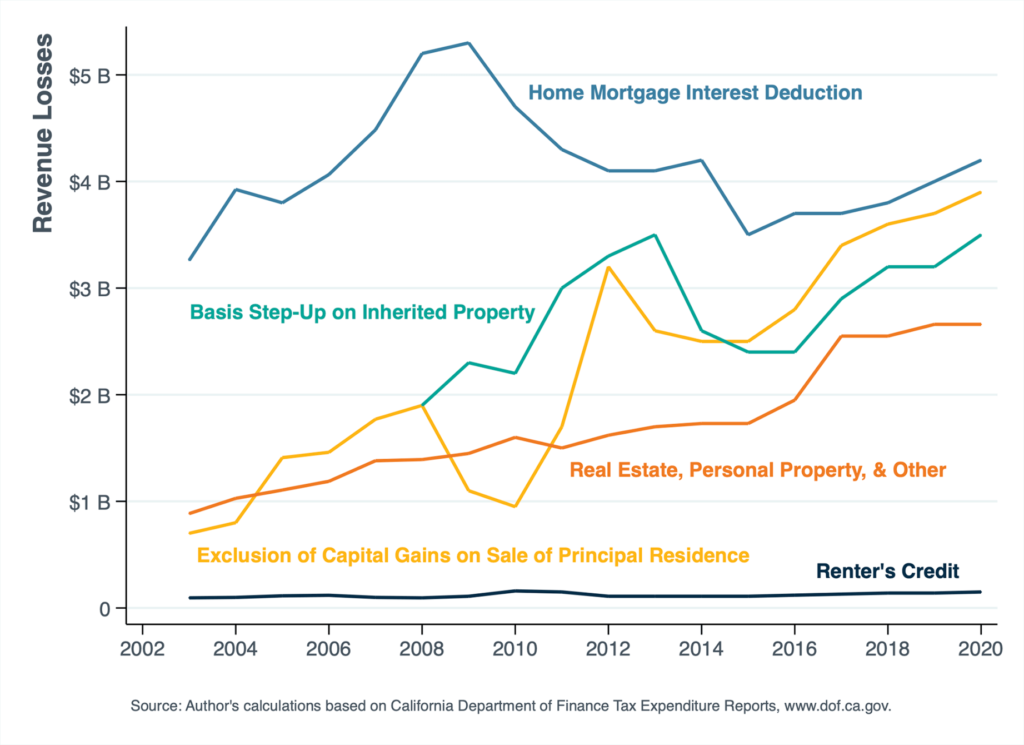

State spending through the tax code on renters pales in comparison to support for homeowners. While the Renter’s Credit has seen little growth since 2003, benefits accrued to property owners have increased by almost 200% during the same period. In 2019-2020, $4.3 billion will be spent on the state Home Mortgage Interest Deduction alone, while only $140 million will be spent on the Renter’s Credit. Although homeownership is an important policy goal, tax expenditures for housing and property owners primarily benefit those who are older and wealthier. For a state where 45% of people are renters, the tax code reflects little parity between homeowners and renters.

This policy analysis aims to answer the question: If California were to support renters through the tax code on the same scale it does homeowners, what would that look like, and how many renters could the state help?

Spending on Tax Expenditures Related to Housing and Property Ownership