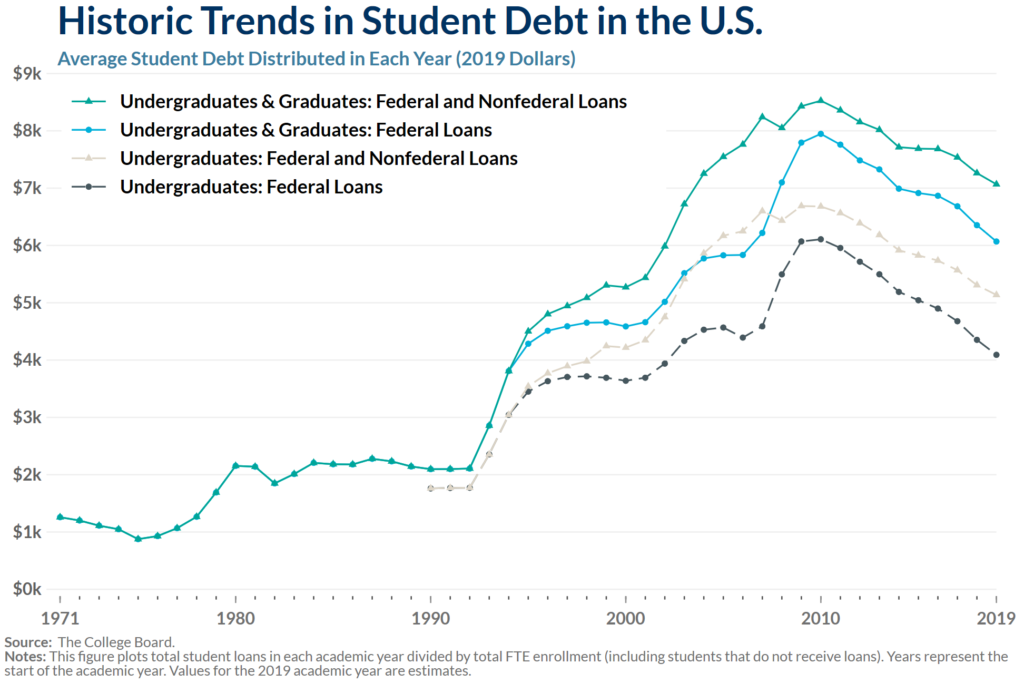

Student debt has been on the rise since the 1970s. Below, we break down trends in student debt over time by plotting all total student loans in a given year divided by total full-time student enrollment. In other words, we plot how much debt each full-time student enrolled in higher education would have if the debt were distributed evenly. As shown, average student debt significantly increased between 1991 and 2010, reaching a high of roughly $8,500 in 2010 before beginning a gradual decline. Federal loans for both graduate and undergraduate students are the most prevalent (the black and blue lines), although the uptake in private, nonfederal loans have increased dramatically since 1992–according to the figure, each student in the U.S. carried about $1,000 in private loans during 2019.