Governor Newsom’s revised K-12 budget could foreshadow future problems for CA schools

On May 12, Governor Newsom released an updated budget for 2023-24 fiscal year. The new budget proposal reflects a more pessimistic revenue outlook; the budget projects a budget deficit $9 billion larger than in January, and a total of 1 percent less spending overall than in the 2022-23 fiscal year.

The revised budget includes$127.2 billion for K-12 education. While the revised education budget largely protects certain priorities for the administration, like an 8.2% cost-of-living adjustment that was promised, given the increase in the projected overall budget deficit for the state, the new budget proposal also claws back billions in one-time funding that was approved last year, in order to balance the budget.

These types of short-term budget maneuvers may help to maintain funding for K-12 schools and balance the budget in the short-term, but given the overall climate of economic uncertainty, the Governor’s budget should be considered a best-case-scenario. Should the economy enter another recession, California’s structural budget problems may lead to potential budget cuts for K-12 schools.

“A modest decrease” in the K-12 budget

Glance at the Governor’s updated state budget for the coming year, and you might notice the mention of budget cuts from the originally proposed $109 billion K-12 budget, which had been a modest 0.3% bigger than the 2022-23 fiscal year. The revised budget notes that available “resources have declined.”

In California, a proposed education budget can decline between January and May because the state’s education budget is built on a volatile revenue system.

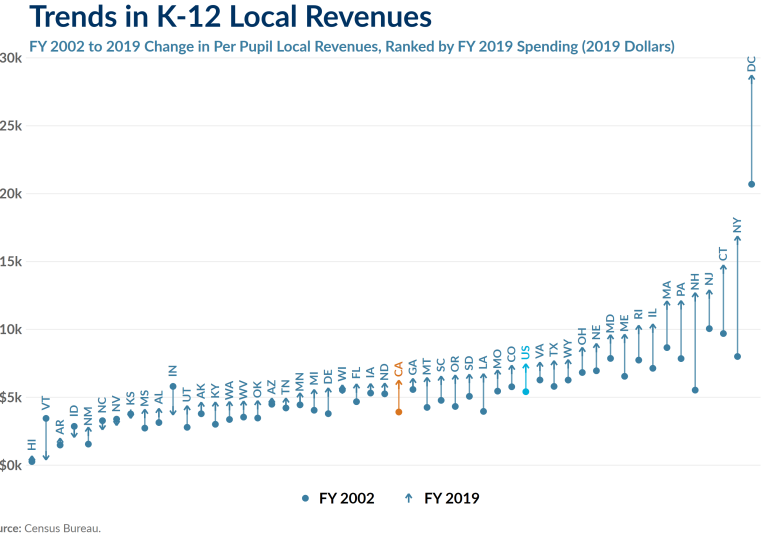

California significantly limits how much revenue may be collected from property taxes, which in most states is typically a significant and stable revenue source for K-12 schools.

As a result, K-12 funding is based largely on volatile income, sales, and capital gains taxes. These taxes change with the economic tides. When the state economy grows, so does the education budget. If it falls, education funding falls with it.

This is frustrating for educators. An assistant superintendent interviewed by AIR put it this way: “One of the frustrating parts of my business is the rollercoaster [ride]; there seems to be no consistency from one year to the next.”

Just how bad can it get?

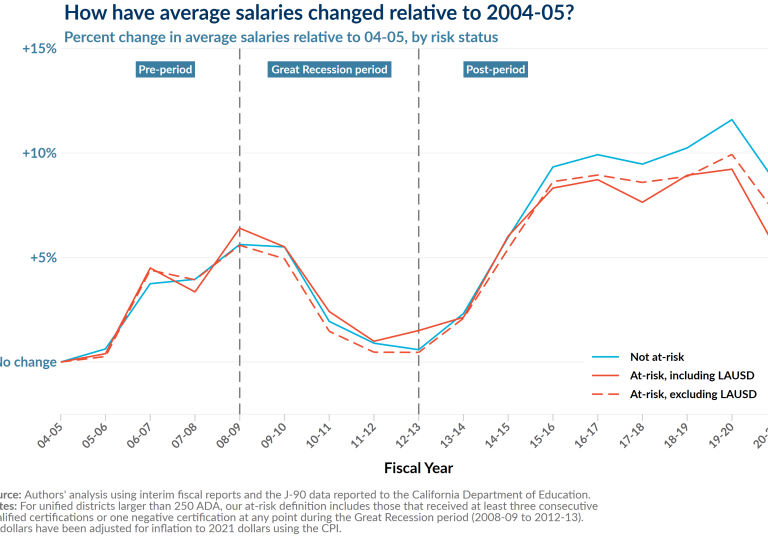

The Great Recession demonstrated what happens when the rollercoaster takes a dip.

Five percent of California’s teachers were laid off in 2009 alone when the state suspended the minimum funding guarantee established by Proposition 98, and by 2012, the teacher workforce shrank by 11 percent.

Districts increased class sizes and shortened the school year. Many also made programmatic cuts, like dropping electives in high schools.

The threat of a recession

There are a number of indicators that the economy may not continue on its course of slow growth, which could push California off its current path. Many economists speculate that inflationary pressures and ongoing rate hikes from the Federal Reserve in response could lead to an economic recession. Ultimately, we don’t know when the next recession will strike.

If even a moderate recession occurs, it could quickly deplete California’s rainy-day funds.

The result may mean a return to harmful budget cuts for K-12, payment deferrals, or other changes to the education code that could impact school quality.

How can we move education funding to stable ground?

The state’s shaky funding structure is a symptom of a more serious issue–Proposition 13. This voter-approved initiative passed in 1978 and restricts how much counties may collect in property taxes. It makes the state over-reliant on less stable sources of revenue.

In order to make state revenue more stable–and by default, stabilize revenue for K-12 schools–we need to keep the conversation going about reforming Proposition 13. This would allow school funding to come from more reliable sources, while also decreasing reliance on volatile income taxes and sales taxes.

We need to explore new avenues for rebalancing the state’s revenue mix.

Until it’s addressed, schools will keep riding the ups and downs of the economic rollercoaster – and California’s students will pay the price.

Learn more about California’s K-12 finance

Discover how California currently funds its K-12 system, where funding levels are, and how it compares to other states in the PDF linked below. You can also check out an op-ed we wrote in EdSource with the Opportunity Institute about the state’s structural budget problems.

Ready to go deep? Explore our full suite of issue briefs on the future of education in California.